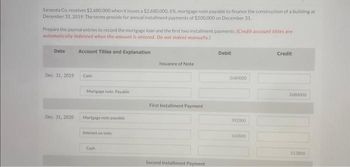

UCC-step one Financial support Statements, known as only UCC-step 1 filings, can be used of the loan providers so you’re able to mention its liberties in order to security otherwise liens into the secured loans.

They are usually registered by the lenders for the debtor’s nation’s assistant regarding county place of work whenever that loan was first began. Should your equity is actually concrete possessions, such as for instance equipment, the financial institution may document the newest UCC lien towards the state recorder’s workplace about state where house is receive.

You are able to easily find UCC-step one filings was pretty popular in the world of short-business lending and generally are nothing to bring about security.

- UCC-step one filings informed me

- 2 kinds of UCC-1 filings

- How come an excellent UCC lien affect enterprises?

- Regular collateral

- How-to seek out or reduce UCC liens

- UCC filing Faq’s

UCC-step 1 filings informed me

While you are acknowledged to possess a little-organization mortgage https://elitecashadvance.com/payday-loans-il/palatine/, a lender might document good UCC money declaration, also known as a great UCC-step one filing. This is simply a legal mode enabling the lending company so you can mention a great lien into the a secured financing. It means the lending company is free to grab, foreclose upon if not sell the root guarantee for individuals who fail to repay your loan.

Precisely what does UCC represent?

UCC represents Consistent Commercial Code, a set of rules that help govern U.S. providers laws and regulations towards commercial transactions. Technically, the brand new UCC isn’t some rules by itself, however, more of a design that individual states realize.

Currently, most of the 50 states, the Section out-of Columbia, Puerto Rico together with You.S. Virgin Islands has accompanied particular sort of this new UCC legislation, but these laws and regulations you should never are very different much away from state to state.

I strongly recommend your research should your lender regularly files UCC-step one filings and needs collateral before you apply for a company mortgage. Even when you might be totally certain that you’ll be able to pay off the borrowed funds, i however suggest alerting right here – UCC-step one filings may affect your business, as we determine in more detail less than.

- This new creditor’s title and target.

- The fresh new debtor’s name and you can target.

- A conclusion of your security .

When was an effective UCC-step 1 filed?

UCC-1 filings usually occurs when a loan try basic began. In case the debtor have funds of more than one financial, the first financial so you’re able to document the newest UCC-step one is first-in range to the borrower’s property. Which motivates lenders to document a good UCC-step 1 whenever a loan is generated.

The first UCC-1 filer holds a first-updates lien, another filer keeps a moment-standing lien and so on. Always, the initial-position lien have to be totally found until the next-reputation lien manager can also be get any leftover equity. In many cases, numerous lenders might work aside an arrangement one to makes significantly more collateral getting junior lienholders. But not, loan providers normally wouldn’t create a borrower so you can reuse an equivalent security for numerous financing.

We stress that we never highly recommend stacking the debt and you will borrowing from the bank off several lenders meanwhile unless of course your online business definitely demands they. Really loan providers will require UCC-step one filings and you will security to secure the funds, and you also don’t want to spread your own property across the multiple lenders. For those who can’t pay off the money, loan providers you’ll grab a serious portion of your and team possessions.

Two types of UCC-step 1 filings

UCC liens up against particular guarantee: These types of lien gets creditors a desire for that or way more certain, identified assets rather than a desire for most of the assets owned because of the a corporate. Talking about normally used for list money otherwise gadgets funding purchases.

UCC blanket liens: This type of lien gives a collector a safety interest in all of the borrower’s assets. It is commonly used having bank loans and you will alternative lenders, also loans guaranteed because of the Home business Management (SBA) . Lenders favor blanket liens because they’re shielded by the several assets and you will try, therefore, less risky. In some instances, good blanket lien you will carve out particular assets that is excused about lien. This may can be found in case the leftover assets be much more than simply sufficient so you can refund the financial institution, will be a default occur.